Account access is currently undergoing unplanned maintenance.

We apologize for the inconvenience and appreciate your patience. Service will be restored as soon as possible.

The Local Advantage

With 20+ locations across Ohio, a Heritage Cooperative® grain facility is never far away. Between our well-trained employees and well-maintained equipment, our goal is to get you unloaded and back on the road as quickly as possible. Many of our locations are open extra hours during harvest season to keep local combines rolling.

Just as importantly, however, is that your Heritage grain team works for you, our farmer-owners. It’s in our best interest to get you the highest possible price for your grain. Our traders are in the market every day, and bring years of grain marketing experience to bear on your behalf.

DTN Cash Bid Updates

Subscribe to receive daily cash bid emails and text messages.

Market Commentary

Understand how the latest news and world events are likely to affect U.S. grain markets. Our grain specialists weigh in weekly.

Cash Bids & Futures

Ada

| DP ONLY | APR - SEP 24 | ||

| Corn | - | - | - |

| Corn - Feed Mill Sale | - | - | - |

| Soybean Meal | - | - | - |

| Soybean Meal-Extruded | - | - | - |

| Soybeans | - | - | - |

| Wheat SRW | - | 4.79 -0.70 | - |

| FUTURES MONTH | LAST | CHANGE | HIGH | LOW |

|---|---|---|---|---|

| Corn May 24 | 432'6 | 6'0 | 433'6 | 426'6 |

| Corn July 24 | 442'4 | 6'2 | 443'0 | 436'0 |

| Corn September 24 | 450'4 | 5'4 | 451'4 | 444'6 |

| Corn December 24 | 465'2 | 5'2 | 466'2 | 459'4 |

| Corn March 25 | 478'0 | 5'0 | 478'6 | 472'4 |

| Corn - Feed Mill Sale May 24 | 432'6 | 6'0 | 433'6 | 426'6 |

| Corn - Feed Mill Sale July 24 | 442'4 | 6'2 | 443'0 | 436'0 |

| Oats May 24 | 358'0 | 3'2 | 358'6 | 349'6 |

| Soybean Meal May 24 | 344'9 | 6'9 | 345'8 | 337'6 |

| Soybean Meal-Extruded May 24 | 344'9 | 6'9 | 345'8 | 337'6 |

| Soybeans May 24 | 1152'0 | 17'6 | 1152'6 | 1131'6 |

| Soybeans July 24 | 1167'2 | 18'2 | 1167'6 | 1145'6 |

| Soybeans August 24 | 1168'4 | 17'2 | 1169'2 | 1148'4 |

| Soybeans September 24 | 1157'4 | 15'6 | 1158'2 | 1139'0 |

| Soybeans November 24 | 1163'6 | 14'4 | 1164'0 | 1146'6 |

| Soybeans January 25 | 1175'6 | 13'6 | 1176'0 | 1159'6 |

| Wheat SRW May 24 | 549'4 | 12'6 | 558'6 | 536'0 |

| Wheat SRW July 24 | 566'0 | 13'0 | 574'6 | 552'2 |

Current Rates & Discounts

Download our current rates and discount information for your crop and location.

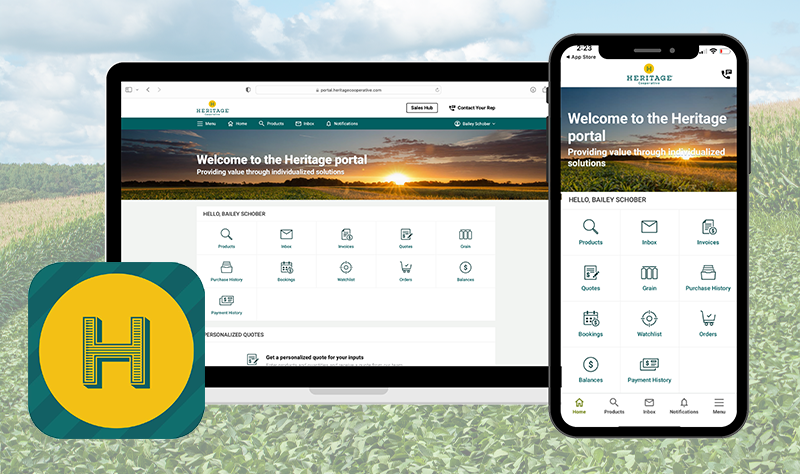

Grain App

Download the Heritage Cooperative App to manage your grain business from a one-stop shop.

Grain Marketing & Services

There are plenty of options for storing, selling and taking payment for your grain at Heritage Cooperative. Click on any of the programs below or contact our grain team. We'd be happy to provide further explanation.

Spot Sale Basis Contract

Hedge to Arrive Contract Target Price Order

Delayed Price Deferred Payment

Grain News

DTN News

At Heritage, we ensure our members and customers have access to the latest in agricultural industry news to support their business decisions. DTN News provides the most up-to-date information on crops, livestock, market updates and more.