Weekly Crop Commentary - 11/14/2025

Nov 14, 2025

Haylee VanScoy

Director of Grain Purchasing

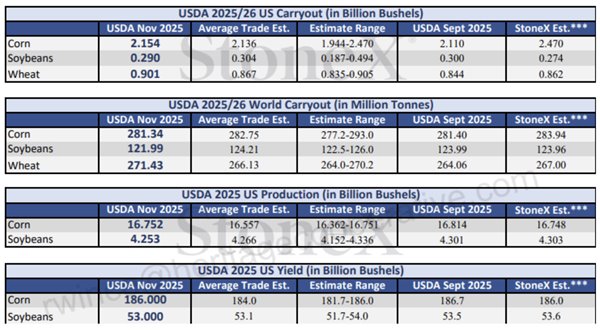

Grain markets got a reality check today, pulling back hard after stacking on a little too much premium the last few weeks and hitting key resistance levels. With the government finally reopening, we were met with a long-overdue WASDE and a flash-sale data dump that quickly took some air out of the market. USDA held corn fairly steady, nudging carryout to 2.154 billion bushels, while soybeans tightened slightly to 290 million. Both corn and bean yields were trimmed—corn down to 186.0 and soybeans down to 53.0 bpa. Even so, the report didn’t deliver the bullish spark the trade had been pricing in, and the market reacted accordingly.

On the demand side, the USDA maintained feed and ethanol usage at levels that still seem somewhat inflated, and soybean exports were reduced by another 50 million bushels. Meanwhile, recent flash sales have shown China booking 323,000 MT of U.S. beans and “unknown” destinations adding 616,000 MT since early October—solid activity, but not enough to justify the premium built into the market over the past few weeks. With beans rallying more than a dollar in six weeks and corn up over 25 cents since October 1, today’s pullback feels more like a needed reset than a reason to panic.

If you’ve captured some of this rally—or still need to—now is a good time to talk through strategy heading into winter. Don’t forget that we’re only 2 weeks away from needing to have deferred payments in if you want to accrue interest for January payments. Please make sure to check in with your local merchandiser to discuss your needs! Wishing you all a plentiful and safe finish to harvest!

Briana Holtzman

Grain Merchandiser, Kenton (Region 1)

It felt like winter early this week. I saw about 2.5 inches of snow at my house. I think we’ll see harvest wrapping up this weekend for most farmers. As we wrap up this harvest, we start looking forward to next year. Please let your merchandiser know if you would like to schedule a meeting to review a marketing plan for any bushels you have stored on DP, at home in the bin, and to begin planning for next year's harvest. The weather forecast next week is looking wetter but also warmer – no chance of snow.

The long-awaited WASDE report was finally released. The report showed corn yields cut 0.7 at 186.0 bpa and bean yields cut 0.5 bpa at 53.0 bpa. The markets did not react positively and fell quickly before stabilizing slightly. While we saw some issues in yields in Ohio, the country as a whole seems to have done alright, with a large crop harvested this fall. The government just reopened this week, and this WASDE may not be as accurate as it can be. I believe that the December WASDE report will provide us with a much better understanding of where we stand on yields, carryout, and exports. However, we are not seeing any massive flash sales to China reported today. Sales to China were reported at 323,000 MMT, and sales to Unknown Destinations were reported at 616,000 MMT. Without concrete data to show follow-through on the trade deal, was it more of a de-escalation tactic than an actual deal?

Zane Robison

Grain Merchandiser, Urbana (Region 3)

Markets saw another volatile week. Corn was in the midst of its best run since July, finally pushing toward the $4.40 futures level and breaking out of the rangebound trade we’ve been stuck in for months. All that momentum was wiped out with today’s WASDE report. While exports did increase, it wasn’t enough to offset the smaller-than-expected yield reduction. The Ohio yield was left unchanged at 194 bu/ac, and the national average fell just 0.7 to 186. With a 2.1-billion-bushel carryout still hanging over the market, it’s tough to find much bullish news in the near term.

Soybeans have been on quite a ride as well. Today’s report also brought the long-awaited flash sales that had been missing since October 1st. China did make some purchases, but not enough to keep beans in the green after the USDA cut export demand by 50 million bushels. Even so, the market has rallied nearly $1.50 off this summer’s lows. That said, questions are emerging about how much additional upside remains. A report earlier this week suggested China has shifted back to buying cheaper Brazilian beans, and with South American planting progressing smoothly, it’s fair to wonder how much higher this market can push.

As we head into the holiday season, it’s easy to get lost in the shuffle—but the market doesn’t wait for decisions to be made. If you have pricing goals in mind or would like to discuss strategy, please don't hesitate to reach out.

Have a great weekend!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon. The long-awaited November USDA report is out. The USDA essentially maintained corn carryout levels, increasing from a 2.11-billion-bushel carryout to a 2.154-billion-bushel carryout. Beans were lowered from a 300-million-bushel carryout to a 290-million-bushel carryout. The market is pulling back from its highs as I write this article. Corn is down 10¢ and beans are down 19¢ right now. With beans setting a new high for the Jan 26 contract earlier today and corn rallying more than 25¢ since October 1, it is no surprise to me to see this pullback today.

Both corn and soybean yields per acre were also pulled back today; corn decreased from 186.7 to 186.0, and beans decreased from 53.6 to 53.0 per acre. I expect the final yield number for corn in January to be pulled back even further. With the reset today from the USDA, it shows us that there is no need to run prices up to ration demand. Beans have rallied more than a dollar per bushel in six weeks, and I still believe we need to reward that move, not only for the crop in the bins, but also for the crop that will be planted next spring. Below is a snapshot of the USDA numbers from today. Contact us to discuss all your options.

Have a great weekend.

Morgan Hefner

Grain Merchandiser, Nashport (Region 5)

The government announced its reopening this week after a 43-day shutdown. Now they will be playing catch-up on export sales reports until January. There was not a whole lot of movement in the markets this week before today. On that note, the USDA WASDE November report was released today at noon. The report showed U.S. corn yields at 186 and bean yields at 53. The slightly higher yields were just enough to put the markets on a downward slope for the day. After the report and as I write, corn is down 10¢, January beans are down 22¢, and wheat is down 10¢ on the day.

The bulk of harvest has been completed in Ohio, with the remaining likely wrapping up here in the next few weeks. As we enter the slower winter months, this is a good time to think ahead to marketing next year’s crop. Creating a plan or setting goals for the coming year would make decision-making easier when opportunities arise.

Have a great weekend!