The Local Advantage

With 20+ locations across Ohio, a Heritage Cooperative® grain facility is never far away. Between our well-trained employees and well-maintained equipment, our goal is to get you unloaded and back on the road as quickly as possible. Many of our locations are open extra hours during harvest season to keep local combines rolling.

Just as importantly, however, is that your Heritage grain team works for you, our farmer-owners. It’s in our best interest to get you the highest possible price for your grain. Our traders are in the market every day, and bring years of grain marketing experience to bear on your behalf.

Ask the Expert: Grain

Have a question about grain marketing, pricing strategies or world and national events affecting the grain markets? Send them to us, and read the answers to previous questions here!

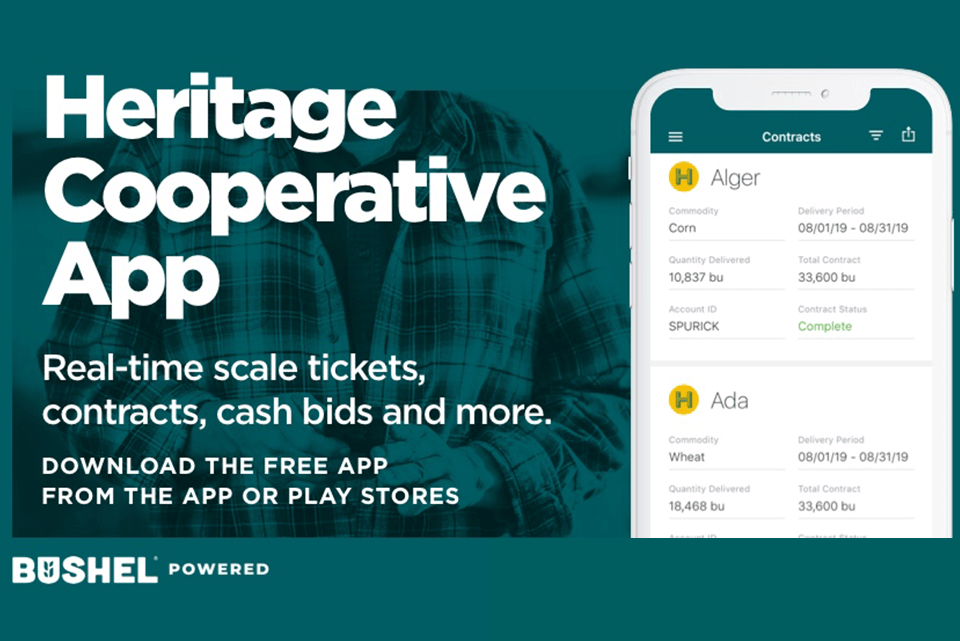

New Grain App

The Heritage Cooperative app provides real-time harvest information to better serve you.

Cash Bids & Futures

Weather

Fri 2/27

Sat 2/28

Sun 3/01

Mon 3/02

Tue 3/03

High

57 F

53 F

35 F

38 F

49 F

Low

27 F

35 F

24 F

21 F

29 F

Precip

0 %

32 %

51 %

39 %

80 %

Current Rates & Discounts

Click to download PDFs

Grain Discount Schedules

Rates & Service Charges

Not seeing what you need?

Contact us with your questions.

DTN Cash Bid Updates

Subscribe to receive daily cash bid emails and text messages.

Grain Marketing & Services

There are plenty of options for storing, selling and taking payment for your grain at Heritage Cooperative. You may click on any of the topics listed below, contact our Grain Department. We’d be happy to provide further explanation.

Click each topic for more information

Spot Sale

Grain is delivered to the elevator for the current cash price. Unless specified, bushels delivered for cash/spot sale will receive the closing price on the day the grain is delivered.

Fixed Price Contract

An agreement that establishes a fixed price, Chicago Board of Trade plus local basis, for a specified amount of grain to be delivered to a named location during an agreed upon delivery period.

Basis Contract

An agreement that establishes basis, which is the difference between the Chicago Board of Trade and the local cash grain price, for a specified amount of grain for any delivery period and location. The basis is the only fixed portion of the price. A monetary advance can be requested after delivery of the bushels. Final Pricing must be completed prior to an agreed upon expiration date.

Target Price Order

The customer sets a target price that if hit will result in a fixed price contract or as pricing for delayed price bushels. If the target is hit the contract is written or the delayed price bushels are settled.

Hedge to Arrive Contract

An agreement that establishes the Chicago Board of Trade price for a specified amount of grain to be delivered to a named location during a specified delivery period. The delivery period cannot exceed 12 months from the contract date. The futures price is the only fixed portion of the price. Final pricing must be completed prior to an agreed upon expiration date or at time of delivery, whichever occurs first. Service fees will apply.

Delayed Price

Grain can be delivered to the elevator with title passing to Heritage Cooperative. The customer can price the grain for the current market price at a later date.

Open Storage

Grain is delivered to the elevator and title remains with the customer. Open storage is commonly used for government loan programs. Space available for open storage may be limited and storage rates will apply.

Deferred Payment

The customer may elect to defer payment for grain delivered against contracts or spot sales. Deferred payment periods are pre-set and current interest rates apply.

Brokerage Service

Brokerage services are available for producers interested in setting up hedging accounts for their personal farm operation and risk management practices. The trading of futures and options involves substantial risk of loss and is not suitable for all investors.

Grain News

DTN Midday Grain Comments 02/27 10:47

2/27/2026 - 11:18:00

DTN Midday Grain Comments 02/27 10:47 Corn, Wheat Futures Higher at Midday Friday; Soybeans Flat-Lower Corn futures are 2 to 3 cents higher at midday Friday; soybean futures are flat to 2 cents lower; wheat futures are 10 to 14 cents higher. David M. Fiala DTN Contributing Analyst MARKET SUMMARY: Corn futures are 2 to 3 cents higher at midday Friday; soybean futures are flat to 2 cents lower; wheat futures are 10 to 14 cents higher. The U.S. stock market is weaker at midday with the S&P 35 points lower. The U.S. Dollar Index is 15 points lower. The interest rate products are firmer. Energy trade is firmer with crude up 1.50 and natural gas is up .02. Livestock trade is weaker with cattle sharply lower. Precious metals are firmer with gold 60.00 higher. CORN: Corn futures are 2 to 3 cents higher at midday as March goes into delivery with spread action firming as we push to fresh post-report highs. Ethanol margins are starting to get a boost from spring/summer blends coming online to encourage blenders, along with the broad jump in energies this week. The export wire saw 257,000 metric tons (mt) of corn sold to unknown. Basis will likely see little near-term change into March delivery. New-crop price ratios are favoring corn slightly after the bean strength eased. On the May chart, support is the 20-day moving average at $4.39, with resistance the Upper Bollinger Band at $4.45, which we are testing at midday. SOYBEANS: Soybean futures are flat to 2 cents lower as we ease back from overnight strength with light profit-taking and overbought conditions limiting buying into the end of the month. Meal was 1.70 lower and oil is 5 points lower. South America looks to continue harvest progress close to average pace with little change to end the growing season in Argentina. Basis will likely remain flat as shipping slowed a bit. The daily wire was quiet to close the week. On the May contract chart, support is $11.35, where we find the 20-day moving average with the fresh high at $11.72 3/4 as resistance. WHEAT: Wheat futures are 10 to 14 cents higher at midday with Chicago action continuing to lead as we pop back to the upper end of the range again, with July remaining just short of $6.00 on both winter wheats. Weather for the Plains looks to stay warmer after the brief cool down with better moisture for the north into March while concerns will linger for the southwest Plains. Matif wheat is solidly higher. On the KC May chart, support is the 20-day moving average at $5.58, which we bounced from, with resistance the fresh high at $5.90 3/4. David Fiala can be reached at dfiala@futuresone.com Follow him on social platform X @davidfiala (c) Copyright 2026 DTN, LLC. All rights reserved.

Market Commentary

Understand how the latest news and world events are likely to affect U.S. grain markets. Our grain specialists weigh in weekly.

Regional Grain Branches

Corporate Office

grain@heritagecooperative.com

877-240-4393

Kenton Grain

800-288-2318

Upper Sandusky Grain

800-686-9278

Urbana Grain

800-424-2584

Mechanicsburg Grain

937-834-2416

Marysville Ag Campus

937-642-3841

Canfield Region

800-772-7707