Weekly Crop Commentary - 09/26/2025

Sep 26, 2025

Wes Bahan

Vice President, Grain Division

Good afternoon. Here we are at the end of September, and another month has absolutely flown by us. We got some much-needed rain this week, anywhere from 1.5” up to 4” in some areas. It's just too bad it wasn’t three weeks earlier; oh well, we can’t change that. The early-harvested beans have been impressive, as most are reporting yields of 60+. Will the later beans hold, or will we see a drop off? I think we see the drop-off, but not to the same degree as last year.

There have only been a few reports of any corn harvest, but the early reports are promising on that as well. We surely would have to see a drop off on the corn planted after Memorial Day, but time will tell on that.

The big news of the week was the Argentine government's removal of export taxes on soybeans, which appeared to spark a mass purchase from China. Reports are up to 40 boats of November through December loading were transacted. If true, that would be the dagger in any chance of Chinese business before the new year. Brazil's fall planting is underway, although in the very beginning stages, they are still planting. We should see harvest pick up once again over the weekend, as the next 10 days look to be wide open at this time. Thanks, and have a great weekend.

Briana Holtzman

Grain Merchandiser, Kenton (Region 1)

Monday was the first day of Autumn!

It was another uneventful week in the grain markets. China has turned to buying up Argentine beans and avoiding the US beans as a protest against the tariffs. US bean sales are 19% below the pace needed to meet the current USDA export estimates.

The US is still experiencing strong corn export demand, primarily to Mexico and other unknown destinations. With the border closed to Mexican cattle due to the screwworm outbreak, they are having to import a significant amount of US corn for feed.

We received a good amount of rain this week. Although it was about a month too late, it will still help replenish some much-needed moisture in the soil. With dryer weather setting in next week, harvest is expected to ramp up. Along with harvest getting underway next week, we will see the USDA release its quarterly stocks and acreage report on Tuesday, so we will keep an eye on market responses to that data.

Have a great weekend!

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

It was a somewhat lost week of harvest, but we certainly needed the rain. It appears we have a great window for the next two weeks. I would believe that we will see most of the soybeans harvested in the next 2 to 3 weeks.

I try not to be the bear in the market as I want to look for the positive. I am having a tough time today seeing how soybeans would have a positive story. China is a no-show for soybean purchases, and they just bought 2.1 MMT (77 million bushel) from Argentina on their blue light special (tax holiday). This pushes China into December before they may need soybeans again. We will have to wait and see if the USDA starts to make adjustments to exports and carryout stocks. Yes, we should aim to pick up some business from other countries, but the chances of meeting USDA export numbers are slipping every day.

I have heard talk of more soybean acres next year, with the cost of fertilizer and corn economics. If you are in that camp, look at next fall bean prices; we are around 10.00 for next harvest soybeans. If carryout stocks grow and we add acres to normal production, 10.00 could look like a home run next year.

Corn seems to be finding good demand in the export market, but we are still looking at a 2.0BB carryout. I am sure farmers will sell any kind of rally we see. Early harvest yields in my area look good so far.

Zane Robison

Grain Merchandiser, Urbana (Region 3)

Markets stayed quiet this week, with little excitement to report. Corn continues to trade in its familiar range, unable to push through that stubborn $4.30 level. Strong export demand and solid ethanol margins have helped soften the sting of what still looks to be a large crop (though not quite as big as once thought). Keep an eye on December futures as harvest ramps up—if we finally crack that $4.30 ceiling, it could be a good window to lock in some bushels.

Soybeans, on the other hand, were once again the weak link. Argentina’s decision to lift export taxes spurred heavy Chinese buying of beans and strong soy oil demand from India. While one might expect this to open up U.S. export opportunities, we haven’t seen that play out yet. With little bullish news on the horizon, soybean futures look vulnerable. Any shift in the balance sheet right now would likely be negative, so getting some $10 beans on the books for next harvest may not be a bad move.

Have a great weekend!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon. I am happy to report that we received some much-needed rain over the past 5 days. It is too late for the soybeans, but it will help the wheat that will be planted over the next few weeks. Grain markets continue to stay range-bound, and there is no sign of that changing anytime soon. This week, we saw Argentina have a tax-free window, and when that happened, China came in and bought some soybeans. It was reported that they bought “around 40” cargoes of beans. That does nothing to help the U.S. export program as we move into fall.

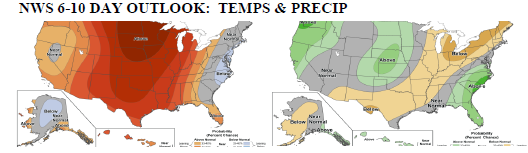

It appears that we will have a wide-open window for harvesting next week. We show no chances for rain over the next 7 days. Below is the latest weather map update for the 6-10 day outlook, on temperatures & precipitation. Harvest looks like it will be able to move along at a relatively steady pace across the U.S.

Once again, I encourage you to call and discuss the wide range of options available to potentially help with pricing some of this year's crop, beyond simply putting your corn & beans in DP. None of the options are a silver bullet, but they can help manage the risk on some of your crop as we move forward. Please give us a call so we can discuss what best suits your farm. No farm is too small, and no farm is too big to use these tools.

Lastly, thank you for all your past business, and we look forward to working with each of you in the coming marketing year. Have a great weekend!!

Morgan Hefner

Grain Merchandiser, Nashport (Region 5)

Monday marked the first official day of fall, and next week is the beginning of October. Fall is my favorite time of year, so I am ready for some cooler harvest weather. Speaking of weather, the rain all week put harvest on pause in Ohio. Now that the rain has passed, harvest will resume this weekend or early next week, depending on your location and the amount of rain you received.

Soybean yield reports from the combines in the eastern part of the state were hit or miss, but overall lower than expected. Although it's still very early in harvest and too early to draw any big conclusions. We will see how yields turn out when we get further into harvest.

In the markets on Monday, beans took the hardest hit after a trade deal with China was not reached last week. To add more pressure, China reverted to buying beans from Argentina following its announced tax holiday. On the U.S. side of things, President Trump mentioned intentions to aid farmers using tariff profits, but so far, there have not been any official details.

As we move into harvest, it is not too late to look at getting some bushels locked in for fall delivery or discuss contracting for after the first of the year. I would be happy to chat about some different contracting options with you!