Weekly Crop Commentary - 3/3/2023

Mar 03, 2023

Vice President, Grain Division

The grain market’s have been trading on both sides of unchanged this week. Traders seem to be focused on weather issues in the southern hemisphere, too much rain in the north, and continued heat in the south. Harvest delays in Brazil have given us an opportunity to extend our export season into early spring. Rumors of China looking for old crop corn vessels has also added some excitement to the market. Corn currently is down a dime on the week and soybeans are trading unchanged. Basis is also steady for the week, and with no carry in CME futures price, the basis will have its work cut out for us this spring and summer. USDA will release updated supply/demand numbers on Wednesday at noon. Could see a slight rise in corn (1.267) and small adjustment in bean carry-over figures (.225). The USDA prospective plantings report and grain stocks update will be released on Friday, March 31. Please continue to be safe and have a great week.

Wes Bahan

Vice President, Grain Division

Good afternoon. Well the market meltdown from last week continued into the first half of this week, before bouncing back. There were a few factors that can be attributed to the rebound. First could possibly be beginning-of-the-month fund buying, secondly, we had rumor of a big Chinese purchase, and third could be attributed to some bottom picking. If China bought corn, it was in a small enough amount that it didn’t have to get reported to the USDA, which should end all discission of a BIG purchase, or they just flat didn’t buy any US corn. With the corn market losing fifty cents in less than a week after being stuck in a trading range for the last six month, we most likely are seeing some bottom picking. Planting in the south is beginning to fire up and looks like we could see several million acres taken away from cotton production. Also, with the current crop insurance price, corn is the same as last year compared to the bean price, which is 57 cents lower than last year’s price. This coupled with the decrease in fertilizer prices could lead to a much higher corn planting area than current predictions indicate. Spring weather will have the final say on that. The weakness in corn spilled over to beans, but the recovery seems to be much better to end the week. Weather woes in Brazil causing extended waiting times to load, more decreases in estimates of the Argentine crop, and strong board crush margins had the market rebound quickly. Here in the east our markets continue to have ample supplies leading to basis levels continuing to be on the weaker side. With the attractive prices that we have seen farmers have been active sellers before they start field work. The USDA will have its monthly supply and demand report next Wednesday. Please have a nice weekend and hopefully we don’t all float away today.

Haylee VanScoy

Director of Grain Purchasing

Grain markets have remained under pressure over the last week and have been trying to recover from recent lows seeing a 20c rebound in nearby corn, and nearly 50c in beans. CK3 corn fell below 6.25 on Wednesday, which hasn’t been seen since mid-August 2022. SK3 also hit recent lows this week in a relatively range bound bean market. The wheat market, however, is continuing to struggle, finding support at 7.00 WK3. With higher acreage expected and demand concerns, we’re looking at an increase to ending stocks in next week’s March 8th WASDE report. Kansas wheat ratings are only 19% good-to-excellent with over half their acres in the poor to very poor rating, but with other Midwest states seeing some improvement due to better rains in the forecast this week, and the next couple weeks, that is adding further resistance to the market. Fresh news has been lacking. Between rain in the forecast, lack of depth to weekly exports, southern US planting underway with many areas looking to finish up 2-3 weeks ahead of normal, and Brazil safrina corn crop nearing 60% completion on planting, there’s not much to feed the bulls right now. Bargain buyers appear to have come back into the market after the first of the month though, and rumors of Chinese purchases, which have yet to be confirmed, have aided in the rebound off lows, but we’ll see what next week’s WASDE report brings us. Hope you all have a great weekend! Looking forward to seeing many of you over the following weeks at the regional grain market meetings!

Will Gase

Grain Merchandiser, Upper Sandusky (Region 2)

Happy Friday everyone. As I type this, I am trying to decide whether I would rather have today’s storm be rain or snow. I think I would choose snow… at least it’s nice to look at! Since last Friday, markets have been mixed with corn down 10, beans up 4, and wheat down 12. Markets trailed off at the end of last week and beginning of this week but made a rebound to get close to where we closed a week ago. Seems that we will continue to trade in these ranges likely until the prospective planting report at the end of the month.

USDA is expected to lower the trade estimates for Argentina corn and beans down to 43 mmt and 36 mmt. This comes at no shocker as the country continues to battle drought and reports suggest the trade numbers should be even lower. Brazil is in full harvest mode and looks to be coming in right around where they planned to be for trade numbers of beans. This will help alleviate some of the numbers lost from Argentina.

With the market being volatile, it is always a good idea to know the prices you want and think about getting target orders in. Hope everyone has a great weekend!

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

March came in like a lamb as we saw 70-degree temps on Wednesday. I got out on my motorcycle to enjoy the nice evening. I have been able to get out and ride several days in February, not something I can do every year. I saw in the weather summary that February was the second warmest February on record, and we had only 1/10 of an inch of snow for the month. I will take rain over snow everyday - I don’t have to shovel rain.

Corn continued its slide early in the week. We have not had fund data since their computer was hacked several weeks ago so the market is just guessing as to what they are doing. We finally found some support come in on Wednesday and stopped the bleeding. Export sales were again poor for the week and demand is not picking up. We will have to see if the world is going to need or want our corn. It is not as if we are giving corn away at 6.00 but as I say, the farmer always wants 50 cents more than where the market is at today.

Soybeans have fared better than corn as we continue to see some exports and stocks that are tighter than corn. Crush margins for the processor are very good so they continue to crush as many soybeans as they can. We are getting back close to 15.00 cash beans again. We have pushed this level several times over the winter months. As I have written before, with the large crop out of Brazil it is going to be hard to push soybeans much past this point.

If Mother Nature cooperates, we will see corn planted in the next 5 to 6 weeks here in Champaign County. Spring is just around the corner.

Lisa WarneGrain Merchandiser, Marysville (Region 4)

With the beautiful day we had Wednesday, March definitely came in like a lamb. I’m sure the lion will have something for us later in the month. In a span of five trading sessions, the May soybean futures traded a 72-cent range, hitting it’s high on 2/22 and a 5-week low on 2/28. Fortunately, in the last three days it has recouped about 47 cents of that as of midday Friday. In that same time, the May corn futures lost 59 cents and has recovered 18 cents.

The beginning of the week was rough with end-of-month profit taking, continued strength in the US dollar, and persistent concern over slow export trends. With a new month, we got some speculators in with bargain-buying and a reversal or stagnation of the dollar index. The soy complex also gained some strength from the global edible oil markets with palm oil supply questions out of Malaysia and Indonesia. Seasonally this time of year corn exports should tick up, but we’ve yet to see that so far. It needs to pick up drastically to make up for the slow pace we’ve seen in the first half of the marketing year.

The March WASDE report is next Wednesday, 3/8. This is usually a quiet report ahead of the critical Prospective Planting report on 3/31. Also, this month we are offering several Grain Outlook meetings with a speaker from StoneX who will go over supply and demand scenarios and possibilities for what’s ahead. Be sure to contact your grain buyer to get information on the closest one in your area as some are scheduled starting next week. Have a wonderful weekend!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

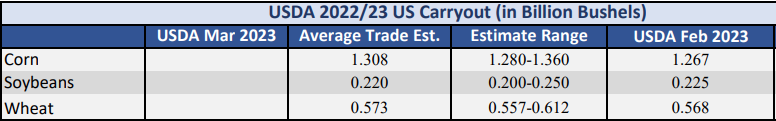

Good afternoon. We are another week closer to the next USDA S&D update. Below are the Average Trade Estimates. As you can see most are looking for a slight increase in the corn and wheat carryout and a slight decrease in the bean carryout on the U.S. balance sheet. We have seen over the last seven trading seasons, corn and wheat pulling back from their recent highs and with these numbers being put out there is no reason for the market to move back to those recent highs in the short term. Beans have seen a bounce over the last three trading seasons and are currently up +.45 cents of their recent lows. Corn has stabilized but has not gained back much either. Beans are a different animal today than corn is. That 220-million-bushel ATG carryout is tight and with crush margins being so good today it’s hard for the bean market to lose a lot of ground. It also feels like we may have tested the lows in the corn market for now. I still feel like the corn market has to stay somewhat supported over the next month to month and a half. We are a long way from having the 2023 crop in the bin let alone planted. We just have too much time ahead of us and we still must keep some premium in this corn market short term.

All of that being said though, we have a couple of things over the next month that could keep some pressure on the market if the numbers that will be published are too bearish. First on March 31st we get the USDA’s Prospective Plantings report. That will be the number USDA puts out based on their survey of farmers across the country. I believe that we will see an increase in corn acres this year. Next on April 11th we will get to see for the first time what the 23-24 balance sheet looks like and the USDA will use the Prospective Plantings Acres to come up with those numbers. I won’t sit here and tell you that I think you should get a lot of your 2023 production locked in. I do understand that with corn prices about a $1.00 per bushel lower and beans about $2.00 lower than today’s cash price it’s a hard pill to swallow. But what I do want to bring to your attention is that if the acre numbers do go up and we don’t have some type of issue during the growing season, I believe we could see prices be cheaper that we are here today.

All of that being said though, we have a couple of things over the next month that could keep some pressure on the market if the numbers that will be published are too bearish. First on March 31st we get the USDA’s Prospective Plantings report. That will be the number USDA puts out based on their survey of farmers across the country. I believe that we will see an increase in corn acres this year. Next on April 11th we will get to see for the first time what the 23-24 balance sheet looks like and the USDA will use the Prospective Plantings Acres to come up with those numbers. I won’t sit here and tell you that I think you should get a lot of your 2023 production locked in. I do understand that with corn prices about a $1.00 per bushel lower and beans about $2.00 lower than today’s cash price it’s a hard pill to swallow. But what I do want to bring to your attention is that if the acre numbers do go up and we don’t have some type of issue during the growing season, I believe we could see prices be cheaper that we are here today.Market Outlook Meetings are coming up. We will get to hear another person’s perspective on what lies ahead so plan on attending one if you can. I hope everyone has a wonderful weekend. We will talk to you again next week.