Weekly Crop Commentary 4/28/2023

Apr 28, 2023

Vice President, Grain Division

The commodity markets have traded lower for most of the week, both corn and beans are down close to fifty cents. China’s cancellation of US corn purchases this week got the sell off started. Corn for export in the Gulf is currently trading at a discount to Midwest domestic corn. This is very unusual, and I honestly cannot ever remember a time that this happened. Lack of export demand for both commodities, the perception that the crop is going to get planted this spring, is weighing on markets. Along with trade belief that carry-over figures for this year as well as next year are going to increase has caused a lack of buying. Lack of foreign demand is pressuring cash basis; it is currently holding its own regionally. However, the inverted old crop futures markets are making it appear a lot better. Nearby trade continues to be hand-to-mouth for just-in-time bushels. The USDA will release revised supply/demand figures on Friday, May 12

Wes Bahan

Vice President, Grain Division

Good afternoon. This week was a terrible week for the grain markets. We received confirmation from the USDA that China canceled a portion of the corn that they had on the books. So far, about 25 million bushels have been canceled. This caused weakness in the corn market, but we also saw a lot of fund liquidation as it is estimated they have reduced their long position by 22,000 contracts over the last two days. These driving factors have July corn trading at a 9-month low this morning, and I’m not sure any buyers want to step in front of this momentum. In Monday night’s report, corn planting is at 14% complete as a nation. The 5-year average is 11%, so we are a bit ahead of schedule. Ohio came in at 6% complete compared to 2% on the 5-year average. Many elevators have rolled their bids to July futures, and in doing so, scaled back basis levels seemingly confirming some demand destruction. Not only did we see cancellations in the export market, but we are also seeing wheat get cheap enough to work its way into the feed markets, displacing demand for corn. However, the EPA is trying to save the day by allowing the sale of E-15 gasoline throughout the summer months. They are hoping to keep the price of gasoline from spiking as the summer driving season approaches, and this should help keep ethanol margins strong. The weakness in the corn market also spilled over into the bean market. It’s not the whole fault of the corn market, that wasn’t a fair statement. Brazil is selling beans at fire sale prices and they are working their way into the crushers along ports in the US. This is going to add bushels to our carryout. I don’t see any way around that. Bean planting is also showing good progress coming in at 9% complete compared to the 5-year average of 4%. Ohio came in at 6% compared to the 5-year average of 2%. There was nice progress made over the last couple days, but next week sure doesn’t look like there will be much progress. Have a great weekend.

Lou Baughman

Grain Merchandiser, Kenton (Region 1)

Markets were hit hard this week. It is the end of another month and a total corn export cancellation for the week of 24 million bushels is a hard pill to swallow. Another thing coming into play is with Brazil’s abundant grain supplies and low prices, this could bring imports to the US.

Being out of the office the last couple of days I got to see some countryside. Ground has been worked and yesterday planters were rolling. The forecast looks like we have a break from that for a week. Hopefully after that warmer temperatures will make what is planted pop out of the ground. Have a good weekend.

Will Gase

Grain Merchandiser, Upper Sandusky (Region 2)

Good afternoon and happy Friday! Once again, it is raining on a Friday. The big story this week is that we saw red across the board and a lot of it. In fact, this whole month has seen a lot of price drops. Since April 3rd (first trading day in April), we have dropped 47 cents for cash corn and 36 cents for new crop corn, and that’s just the beginning. Beans have dropped 86 cents for cash and 78 cents for new crop, wheat is down 74 cents for cash and 78 cents for new crop.

Futures have broken through numerous resistance levels on the way down. Some analysts are still projecting more price drops. They are saying the next resistance for new crop corn would come in at about 5.00 futures, which after basis would put our Upper Sandusky bid around 4.65. Now I cannot imagine that many were planning on 4.50 corn this fall, but currently we are at about 4.90 and there is more stories and data suggesting that corn will keep going down then bounce back up to 5.75-6.00. So, keep that in mind if there is a slight rebound next week and get some bushels contracted!

One of the reasons that corn has continued to drop is our exports. A couple of weeks ago, it seemed China was buying corn left and right every single day. In theory this sounds good, however they are just sales, and the vessels were not loaded for departure. What this means is that China can cancel the sales, and boy have they this week. They canceled another 9.2 million bushels today bringing the total to more than 24 million bushels on the week. If our exports don’t increase, we run the risk of having a higher carryout (grain left over from previous year), which in turn would cause a higher excess of supply this fall. Just some food for thought as we battle with these lower prices. Have a great weekend everyone!

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

If April showers bring May flowers, we should see everything in full bloom next week. We have had 6/10” of rain overnight here in Urbana after a good week of field work and planting. It is amazing how fast the farmer can put a crop in the ground today. The biggest difference I see today verses 5 years ago is that we don’t wait to plant soybeans. We are running corn and bean planters at the same time. We will have to see where planting progress is across the country come Monday night.

Well, I guess at some point I must write about the markets. I was dreading this on my way to work this morning so here we go.

It has been a brutal last 10 days or so for corn, soybean, and wheat markets. The way I see it, there are three things weighing on these markets. First, we saw China cancel corn sales this week. We needed those bushels to move to keep our carryover from growing.

Second, we received rain in the dry areas of the Southern Plains. They experienced the largest rain event since last July. I do not know if this helps their wheat crop, but it matters to Kansas City or Chicago.

Third, the Brazilian farmer is an active seller of soybeans and corn. They had a massive crop and are dumping it on the market today. That is going to press our export sales of corn and soybeans going forward. They also had great weather for their first and second crop corn, so they are filling the need for China in the world market.

It is not all doom and gloom. We still have to plant and raise this year’s crop. There was still snow on the ground in North Dakota and Northern Minnesota early this week. You do not go from snow to corn in a week. Any rally needs to be sold at this time to clean up old crop bushels. I don’t know it we can get back to 6.50 and 15.00 that we saw a couple of weeks ago and several times this winter. We have to be realistic that things have changed in the markets over the last 30 days.

Lisa Warne

Grain Merchandiser, Marysville (Region 4)

Another Friday with rain. At least it’s not snow, right? I heard reports of flurries in Logan County on Monday. There’s corn and beans in the ground throughout this region, but I don’t think enough has emerged yet to have widespread damage by the frosts and freezes we saw early this week. Time will tell, as they say.

The biggest damage of the week has come out of Chicago in the grain markets. The week started with confirmations of China cancelling some of the corn purchases they’ve made. They cancelled 12.9 million bushels of corn on Monday and another 9.2 million bushels on Thursday. Another dagger to the markets was the planting progress report Monday afternoon. US corn plantings were at 14%, compared to an 11% five-year average. US soybeans were 9% planted, compared to a 4% average. The third strike came in verification of Brazil soybeans making their way to the US. With such a huge crop in Brazil, their beans were at such a significant discount that two vessels carrying nearly 3 million bushels were being imported. The US typically imports around 15 million Brazilian beans each year, so this is not uncommon. However, it was more fodder for the bears this week. With the lack of threatening planting weather throughout the Corn Belt, the bulls did not have enough news to support the market. To close out the week and month, some bargain buyers are stepping in today to help soybeans recover some losses. Weather and planting progress will have huge impacts on the market going forward. Have a great weekend and we’ll talk next week!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon, grain markets have pulled back hard this week. We have seen China cancel several cargos of corn this week and weather looks to be changing after the first week of May. Those two things have put a lot of pressure on the markets. Other outside factors to keep your eyes on in the future are the Ukraine – Russia safe corridor passage in the Black Sea Region. There has been talk that Russia is not in favor of extending it once the current agreement expires in May. But the one thing that may push Russia to extend it is China. China has a vested interest in seeing that agreement extended because of what that could do to the current price of corn. China’s cancellations this week would indicate that they believe they will be able to buy cheaper priced corn elsewhere down the road and with Putin building alliances with China that may very well play out.

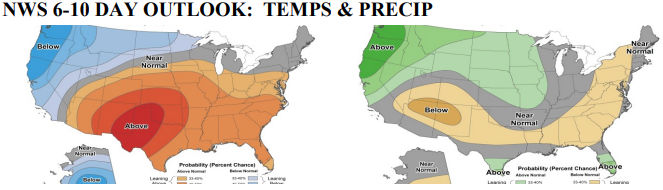

Going forward, if the markets are going to rally back we are going to need some help with a story from somewhere. That could be weather both now as well as into the summer growing season, or we need an outside story to help us. Otherwise, we will probably work softer. I have attached the current 6-10 day forecast maps as of this morning. We will start to dry out, but temps stay colder as well. The 11–14-day maps show a warmup to come in week 2 of May. Have a wonderful weekend!